Wiltshire's top cop for cyber intelligence has issued a warning, after new figures revealed the dangers of fraud.

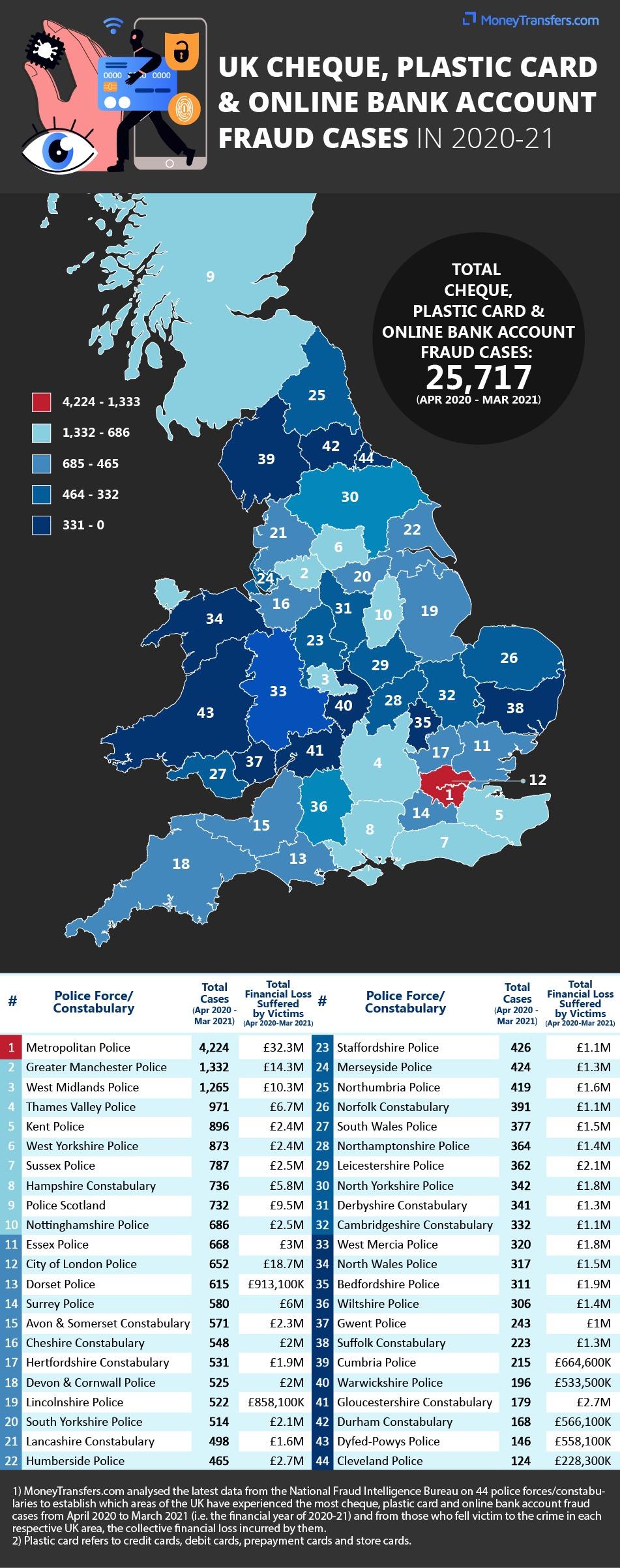

MoneyTransfers.com analysed data from the National Fraud Intelligence Bureau on 44 police forces to establish which areas had experienced the most cheque, plastic card and online bank account fraud causes from April 2020 to March 2021.

July 2020 (2,349 cases) was the worst month, followed by November 2020 (2,341). Whilst April 2020 saw the least number of cases at 1,851.

Additionally, from the 25,717 cases, the collective financial loss that victims suffered was an astronomical £161,221,800 – which equates to a financial loss of £6,269 per case.

Wiltshire Police were in 36th place, as they received 306 reported cases of cheque, plastic card and online bank account fraud from April 2020 to March 2021.

During this period, August 2020, October 2020 and January 2021 (31 cases each) were the worst months. Whilst November 2020 saw the least number of cases at 20.

From those who were targeted, the financial loss equated to £1.4 million; that is comparable to a personal loss of £4,575 for each individual case.

Cyber prevent and protect officer for Wiltshire Police, Lee Stripe, said this in response to the figures.

“We are committed to ensuring residents in Wiltshire are protected from cybercrime and work hard to educate people on the latest scams that we have intelligence on," he explained.

“Protecting your device is important when using it for accessing online banking.

“It’s crucial you keep it up to date as the latest updates contain security patches that protect you against vulnerabilities found.

“Criminals can obtain your details by tricking you into revealing them through unsolicited emails and messages.

“Your bank or building society will never email or message you asking you for your login details or pin. Always access online banking by going direct to the website, don’t click on links sent to you.

“Be careful where you shop online, be wary of adverts advertising goods at prices that are too good to be true or offers that are sent to you.

“Before submitting any card details, ensure the webpage has the green padlock or unbroken key symbol showing in your browser. This encrypts your connection so that it is secure.

“If you can, pay with a credit card as this offers you some protection should issues arise with purchases.

“Cybercrime is known for being under reported. So, we urge, if you have been the victim of online banking or card fraud, please report to Action Fraud, either online or over the phone on 0300 123 2040. You should also contact your bank and stop any further use of your account.

“Please be vigilant and share this information with relatives, friends or neighbours who may be vulnerable.”

In the same data, Metropolitan Police had the highest number of cheque, plastic card and online bank account fraud cases from April 2020 to March 2021, at a shocking 4,224 reports, the equivalent of 12 incidents per day in the capital. From the 4,224 cases, the accumulative financial loss victims incurred was a colossal £32.3 million.

In second position is Greater Manchester Police with 1,332 incidences of cheque, plastic card and online bank account fraud between April 2020 – March 2021. Victims who fell prey to the crime in Greater Manchester experienced an overall monetary downfall of £14.3 million.

West Midlands Police (1,265), Thames Valley Police (971), Kent Police (896) and West Yorkshire Police (873) are among the other police forces which recorded over 800 cases of cheque, plastic card and online bank account fraud from April 2020 to March 2021, respectively ranking in third, fourth, fifth and sixth place.

On the other end in 44th position is Cleveland Police who had only 124 cases of cheque, plastic card, and online bank account fraud.

Slightly above Cleveland Police in 43rd spot is Dyfed-Powys Police, with the Welsh police force reporting 146 occurrences of cheque, plastic card, and online bank account fraud. Despite having a low sum of incidents, the amassed financial loss the 146 victims experienced was still a hefty £558,100k.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here